- The Long Play

- Posts

- 🇮🇹 Juventus are in Desperate Need of Cash

🇮🇹 Juventus are in Desperate Need of Cash

Italian giants Juventus last week rejected a takeover offer. Despite their defiance, they are in severe need of financial stability. Today, we explore...

Thank you to every single one of you who have become a TLP Member.

Later today (Monday 15th December), the football episode of the Saudi Series will go live on YouTube.

The Saudi Series has been a journey for me. Trying to get all the episodes researched, written and edited alongside a time-intensive job has pushed me to physical limits.

However, I am incredibly proud of the content I have created and the football episode is the longest episode yet.

Remember, on January 1 TLP Members will unlock every episode of the Saudi Series. Yes, Episodes 4, 5, 6, 7 and 8 will await you alongside a bunch of other extra Member-Only videos already created. Then of course, you get 12 months access to even more Member-only TLP videos for the whole of 2026.

2026 is a new dawn for TLP and I’d love for you to support me on this journey. Becoming a member is the perfect Christmas present for you or someone you love. If agree, consider joining us HERE. Prices go up at the end of the year.

Thank you once again for an incredible year. Today, we dive deep on two fascinating stories this week.

Saudi Series Episode 3 Thumbnail

The first story is about Juventus, Italy’s most successful football club and one of Europe’s historical giants.

Despite its global brand, the club has endured deep losses over the past decade.

Swiss Ramble reports Juventus has posted nearly €944 million in pre-tax losses over the last decade, including €826 million in the last five years alone(!)

I looked into this further and couldn’t believe my eyes when I saw the numbers. See below for a list of the pre-Tax P/L posted by Juventus since 2020:

2020: -€90m

2021: -€227m

2022: -€239m

2023: -€124m

2024: -€199m

2025: -€58m

The club has been kept afloat largely through capital injections from Exor, the name of the holding company of the Agnelli family. Famous owners of the club.

Speaking of, here’s how the ownership sits currently:

65.4%: Exor (Agnelli family holding company)

11.5%: Tether. Acquired incrementally during 2025

c.23%: Public & other minority shareholders

Last week, Tether, the issuer of the USDT stablecoin submitted an all-cash offer to acquire Juventus by buying the controlling stake from Exor. The proposal valued the club at roughly €1.1 billion.

Tether also pledged up to €1 billion of additional investment into the club’s future if the deal completed.

But, Exor’s board unanimously rejected the offer within 24 hours reaffirming that Juventus is not for sale.

In the public press release, Exor chairman John Elkann said that Juventus’ “history and values are not for sale” and reaffirmed a long-term commitment to “build a winning Juve”.

Hmmm.

What makes this news revealing isn’t the offer itself, but the company who made it.

A stablecoin company trying to buy one of football’s most historic institutions would have sounded absurd five years ago. Crypto companies now have such deep pockets that they can acquire assets like Juventus. In addition, this particular crypto company believe Juventus, who have been a cornerstone of European football are mispriced and/or financially vulnerable.

Juventus are in a difficult spot. The club needs stability, competitiveness and as I showed you earlier, financial repair all at the same time. They are currently fifth in Serie A, with a weaker squad than its direct rivals and no space for another expensive reset.

If Exor can no longer be the financial benefactor, something else has to change. Either Juventus becomes genuinely self-sustaining which… seems a long way off, or the pressure from outside capital doesn’t go away.

Lets see where Juve end up in 2026.

It is genuinely plausible that Juve season ticket purchases could be made through stablecoins at some point in the near future. How mad!

Elsewhere, the Women’s Tennis Association (WTA) just landed the biggest commercial deal in its history.

Mercedes-Benz has been named the WTA’s new Premier Partner, a newly created top-tier sponsorship category that now sits above traditional title sponsorship.

According to reporting from the BBC, Mercedes will pay $50m per year for ten years, meaning this deal is worth $500m in total value.

This is the most valuable sponsorship the WTA has ever signed and more-than-doubles their previous deal:

Mercedes-Benz: $50m per year

Previous title sponsor (Hologic): $18-20m per year

Whilst this is a notable piece of news, I find it particularly interesting because this deal doesn’t happen without WTA Ventures.

WTA Ventures was created in 2023 as the commercial arm of the womens’ tour. The goal of the company was to “modernise sponsorship, media and licensing” in a way the old federation-led model struggled to do.

It sounded like corporate marketing spiel at the time but since its formation:

WTA Revenues are already up 24%

The sponsorship portfolio has been rebuilt from the ground up

Assets are now packaged globally, not tournament-by-tournament

This latest Mercedes deal is the clearest proof yet that the new structure is working.

WTA Ventures is part of a wider shift across sport towards separating the commercial rights into purpose-built entities that can move faster, price properly and negotiate from a stronger position.

We’re seeing the same in the UK with NewCo. A company specifically set up to be the commercial arm for the the WSL. NewCo negotiated the new broadcast rights for the WSL and secured a 60% increase on the previous deal with Sky Sports. It was seen as a seminal moment for Women’s football in England.

Federations and governing bodies were never designed to behave like modern media businesses. These new commercial arms are.

So far, they seem to be working very well, especially for the Women’s Game! Do not be surprised if more and more commercial SPVs sprout up in the years to come.

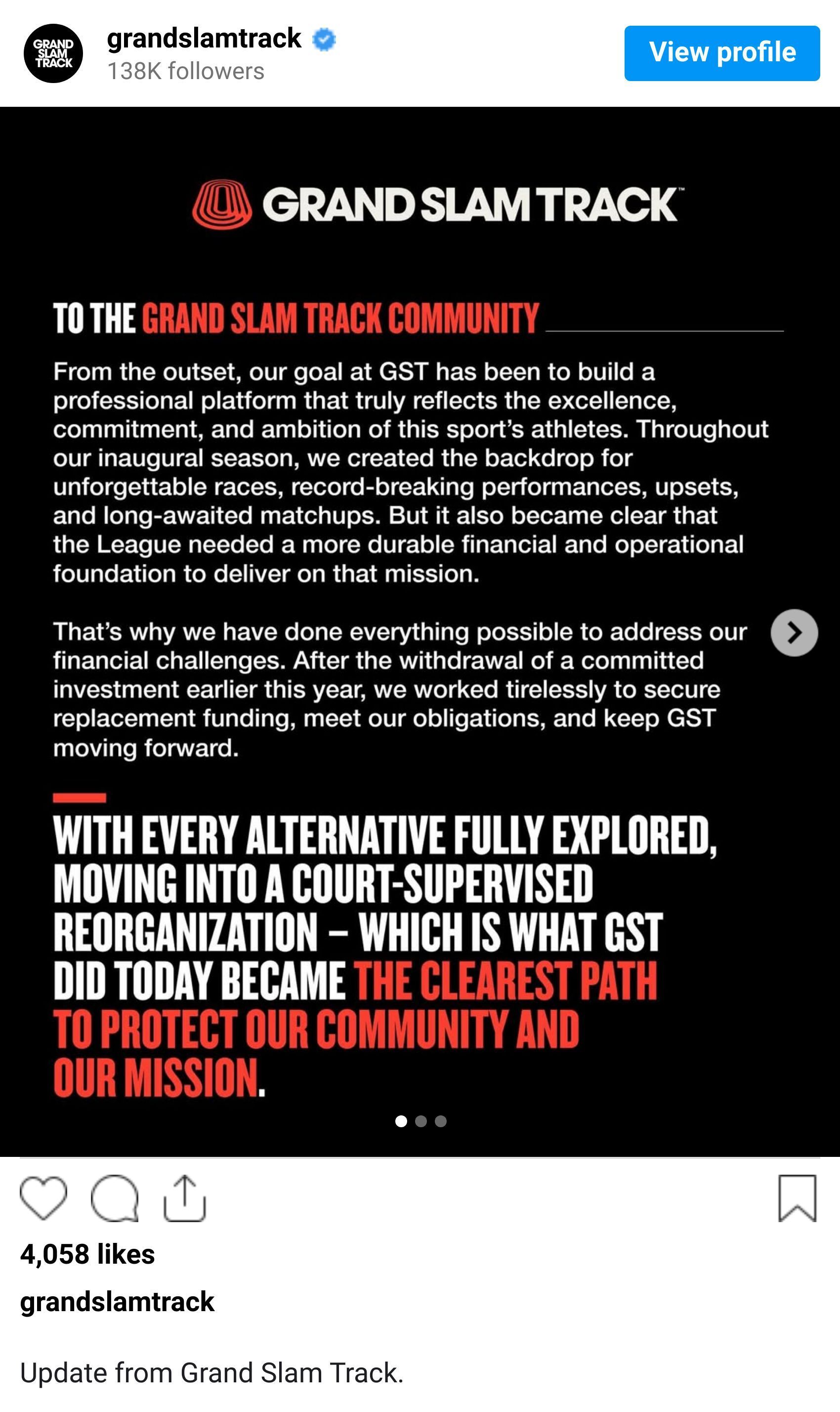

Finally, before we get out of here. Something that isn’t working so well, is Grand Slam Track.

Last week Michael Johnson’s GST filed for bankruptcy in an attempt to stabilise its finances.

I’ve said this before and I’ll say it again, MJ was onto something with Grand Slam Track. The execution however, has been appalling from beginning to end.

What’s worse, are the comms that come from the company. This Instagram post from last week is… full of waffle 🥴

A sad journey from one of the sports greats.

Get a TLP Membership for you and someone close to you HERE.

See you next week.